NCIP Private Flood Insurance

Quote Walkthrough

Learn how to quote NCIP personal (aka residential) flood insurance quickly and confidently with CATcoverage.com's producer-focused, page-by-page walkthrough.

Navigating flood insurance quoting doesn’t have to be complicated. This walkthrough demonstrates to flood insurance agents and professionals how to quickly and efficiently quote residential flood coverage using CATcoverage.com. Whether you're new to private flood or looking to expand your offerings beyond NFIP, this guide helps you streamline your workflow, retain clients, and unlock competitive commissions with NCIP-backed options.

Ready to get started? Signing up is fast and easy. Once you're done, simply log in. You can start quoting personal (residential) or commercial earthquake and flood insurance in minutes!

Jump to Section

Page 1: Property Address

Page 2: Perils

Page 3: Appetite and Eligibility

Page 4: Dwelling Information

Page 4: Quick Tips for Clients to Identify Construction Types

Page 4: Foundation Types and Descriptions

Page 5: Peril Deductibles and Coverage Limits

Page 6: Contact Information

Page 7: Mortgagees

Page 8: Inception Date

Page 9: Confirmation, Disclosures, Warranty Information

Page 10: Finalize Application

Page 1: Property Address

Enter the address of the property you wish to quote.

Page 2: Perils

This is where you choose to quote earthquake or flood insurance. To quote multi-peril, select both. In this walkthrough, we'll be focusing on personal NCIP Flood Insurance.

Page 3: Appetite and Eligibility

Read this page carefully to see if the property is eligible for NCIP flood insurance. Misrepresentation may result in the denial of a claim(s) and subject to cancellation of coverage.

Page 4: Dwelling Information

Enter key dwelling details including building use, occupancy type, construction type, and foundation type.

Quick Tips for Clients to Identify Construction Type

-

Wood Frame

-

Look for wooden studs, beams, or siding.

-

Common in suburban homes and newer builds.

-

-

Masonry (Reinforced or Unreinforced)

-

Brick or stone exterior walls.

-

Reinforced types often have steel bars or concrete blocks.

-

-

Masonry Veneer

-

Brick or stone is only a surface layer over a wood frame.

-

-

Mobile Home

-

Typically smaller, may have visible tie-downs.

-

Often labeled as manufactured housing.

-

-

Adobe or Log Cabin

-

Thick earthen walls, often in Southwest regions.

-

-

Log Cabin

-

Visible logs forming the structure.

-

Foundation Types & Descriptions

These each have a sub-selection once clicked on.

Slab On Grade

A concrete slab poured directly at ground level. Common in newer homes and flood-prone areas due to simplicity and elevation.

-

Slab On Grade: Standard slab foundation with no elevation or enclosure.

-

Raised Slab: Elevated slab foundation, typically built slightly above ground level for added flood protection.

Below Grade

The foundation is built below ground level, typically with a basement. May increase flood risk depending on elevation and drainage.

-

Full Basement: Entire area beneath the home is enclosed and fully below ground.

-

Walkout Basement: Basement with an exterior exit, often partially above ground.

-

Subgrade Crawl Space: A crawl space that sits below ground level, offering limited access and ventilation.

Elevated Floor

The living area is raised above ground level, often on piers, posts, or stilts. Designed to reduce flood exposure and meet elevation requirements.

-

Elevated Without Enclosure: Open space beneath the elevated floor, allowing water to pass through.

-

Elevated With Enclosure: Enclosed area beneath the elevated floor, which may trap water during flooding.

-

Elevated Partial Enclosure: Partially enclosed space beneath the elevated floor, offering limited protection and ventilation.

Crawl Space

A shallow space between the ground and the first floor, allowing access to plumbing and electrical systems. Elevation and enclosure type affect flood risk.

-

Crawl Space Without Enclosure: Open sides, allowing air flow and minimal flood resistance.

-

Crawl Space With Enclosure: Fully enclosed with walls, may trap water during flooding.

-

Crawl Space Partial Enclosure: Partially enclosed, offering limited protection and ventilation.

Page 5: Peril Deductibles and Coverage Limits

Select flood deductibles and coverage limits. Once everything is selected, premium can be calculated.

Building Limit: How much insurance coverage you want on the dwelling.

Personal Property Limit: The maximum coverage available is 50% of the building limit.

RCV (Replacement Cost Value): The cost to replace damaged property with new materials of similar kind and quality, without deducting for depreciation.

ACV (Actual Cash Value): The value of the property at the time of loss, factoring in depreciation.

Appurtenant Structures Limit: An Appurtenant Structure is an additional building on the property that you would like to insure. The building must include 4 walls and a roof to qualify. The maximum coverage available is 20% of the building limit.

Additional Living Expense Limit: The maximum coverage available is 10% of the building limit (maximum $25,000).

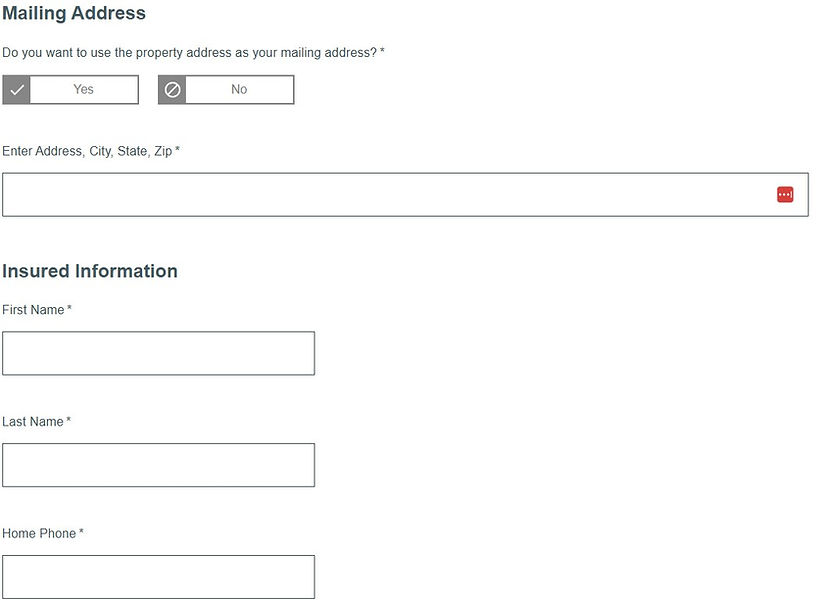

Page 6: Contact Information

This is where we can send the insured important information regarding their policy.

Email: The insured's email is required for digital signature. Please double check it's accuracy before continuing.

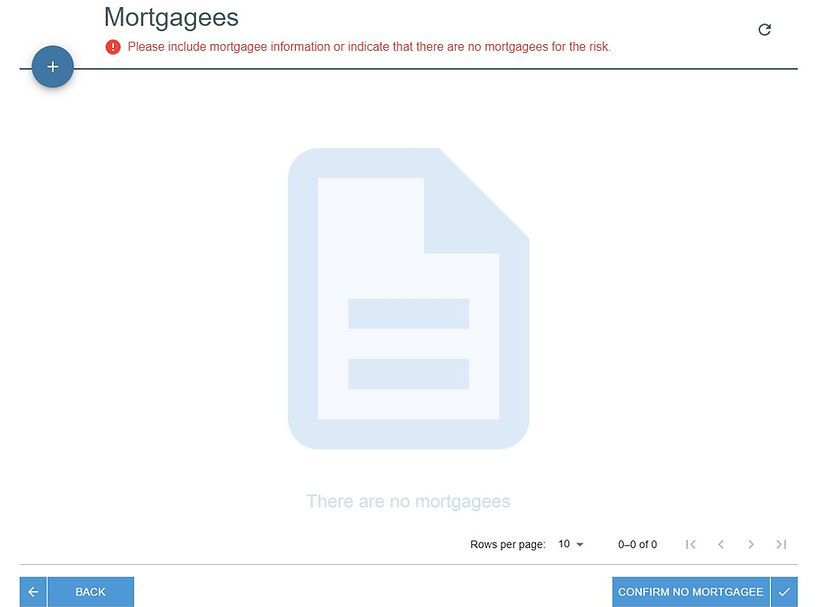

Page 7: Mortgagees

You may add a mortgagee if applicable. The information required will be Name, Address, Lienholder Position, Loan Number, whether or not they should be billed for Renewals, and if the policy is required. You will also be asked to answer Yes or No to include "As Their Interests May Appear?" and/or to include "Its Successors and/or Assigns".

Page 8: Inception Date

Add the date you would like the policy to go into effect.

Page 9: Confirmations, Disclosures and Warranty Statements

The State Required Disclosures will vary by state. You will be asked to acknowledge each section and provide a signature. Clicking Submit Application does not bind the policy. It will submit the application for underwriting review.

Page 10: Finalize Application (if approved)

This page will allow you to review the underwriting, download the application PDF, and allow you to copy the data from the application to a new application for submitting. You can also proceed with payment on this page.

Disclaimer: The content on this site is for general information purposes only. It is not intended to be relied on or used in place of professional advice. We do not endorse, assume responsibility for, or guarantee the accuracy of the content. All liability is expressly disclaimed.